ERP for Oil and Gas: Boosting Profitability & Compliance in 2026

The oil and gas industry is inherently complex, encompassing activities such as exploration, drilling, midstream logistics, refining, and...

3 min read

Eric Smith

:

Dec 2, 2025 12:00:00 AM

Eric Smith

:

Dec 2, 2025 12:00:00 AM

The oil and gas industry faces a unique set of pressures in 2026. While supply chain disruptions have stabilized since the early 2020s, companies now face a dual challenge: strict capital discipline and the urgent need for digital transformation. Public pressure to reduce emissions (ESG) is now a regulatory mandate that requires precise data tracking.

If you’re facing these issues with a legacy ERP, your company may be ill-equipped to compete. Modern enterprise software for the oil and gas industry is designed to help managers gain greater visibility into operations and make smart, data-driven decisions despite formidable market challenges.

Whether your business falls into the Upstream, Mid-Stream, or Downstream leg of the industry, a modern ERP is the backbone of efficiency.

Legacy systems often create data silos—where the drilling team doesn't talk to the finance team. All modern ERPs automate common processes and eliminate these bottlenecks by uniting workers on one platform. But in 2026, "automation" isn't enough. You need Intelligence.

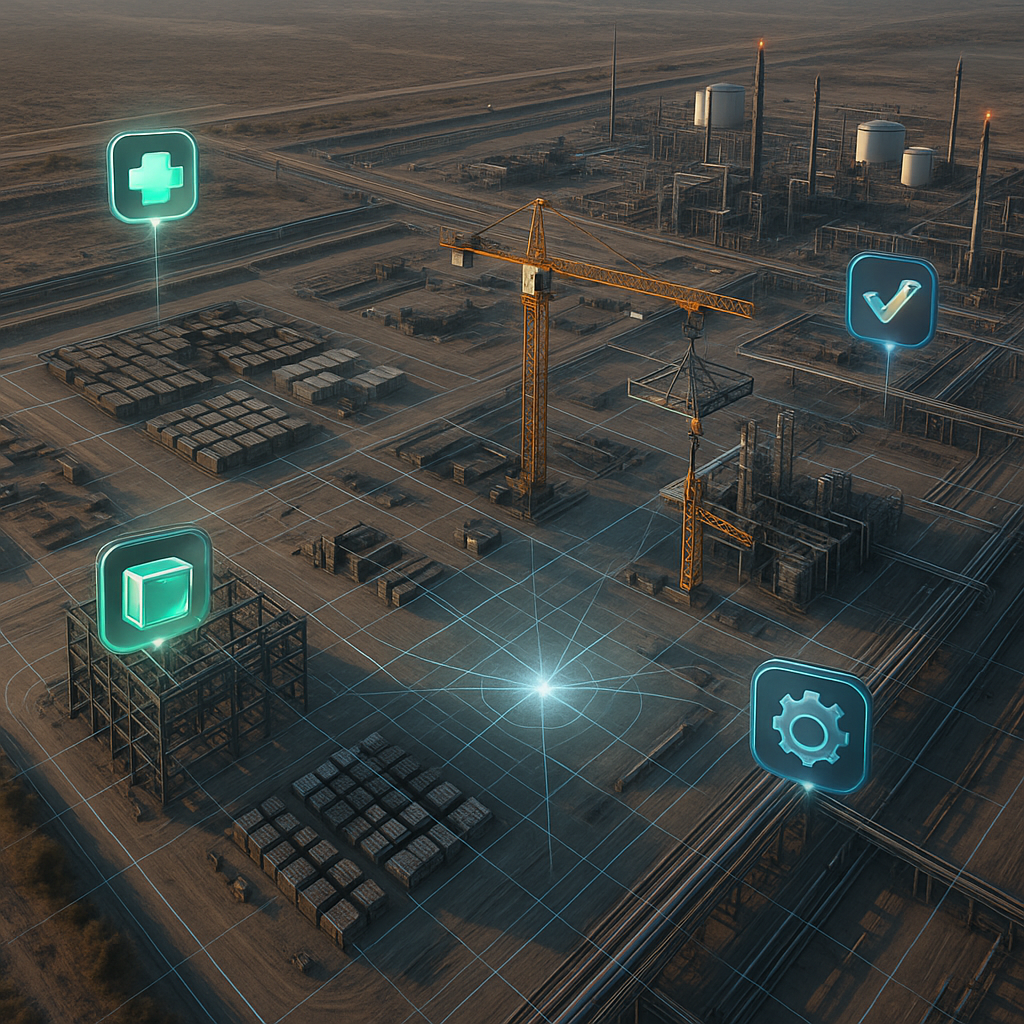

If you are looking to upgrade, evaluate how well each ERP system handles processes in these four management categories:

In 2026, capital discipline is king. To increase efficiency while controlling costs, today’s next-gen ERPs provide managers with in-depth views of all phases of operation.

Real-Time Job Costing: Track expenditures against AFE (Authorization for Expenditure) in real-time, not at month-end.

Multi-Currency & Joint Venture (JV) Accounting: Automatically handle complex revenue splits and partner billing without manual spreadsheets.

Most ERPs have supply chain modules, but Oil and Gas requires specialized handling for "Rotables," pipe yards, and remote inventory.

Visibility First: According to Shippeo’s 2026 Supply Chain Trends, real-time visibility is now the minimum requirement. Your ERP must track materials from the vendor to the remote rig site, ensuring critical spares are available before a shutdown occurs.

This is where the biggest ROI lies. A robust oil and gas ERP unites offshore and onshore operations.

The 2026 Shift: Leading solutions like IFS Cloud use Industrial AI to predict equipment failure. Sensors on a compressor feed vibration data directly into the ERP, triggering a maintenance work order automatically before the machine fails. This moves you from "reactive" repairs to "predictive" reliability.

Since the industry utilizes land and water resources, it’s subject to strict environmental standards.

Automated ESG Reporting: Modern ERPs automatically track carbon intensity, water usage, and waste generation as part of daily operations. This turns compliance from a frantic year-end project into a push-button report.

Cybersecurity: Aging ERPs are prime targets for cyber-attacks. Modern cloud platforms offer "FedRAMP-ready" security postures that protect critical infrastructure data.

With over 30 years of experience in the sector, IFS has built a single integrated platform that addresses these specific needs without heavy customization.

Financials: IFS solutions enable accurate accounting across multi-jurisdiction and multi-language operations. Companies implementing IFS have experienced a 10% reduction in management costs through better labor force control.

Supply Chain: IFS tracks site-to-site and site-to-customer movements with automated rule-based sourcing. It simplifies the complex permitting process for land exploration, expediting the supply chain flow.

Asset Management: IFS is a leader in Enterprise Asset Management (EAM). Authorized users have immediate access to asset-impacting details such as well log analysis and seismic processing. By integrating this with financial data, you get a true picture of asset profitability.

When the need for a real-time overview of an offshore rig became apparent, one major operator chose IFS. The robust, industry-specific functionality allowed them to link onshore and offshore teams, streamlining supply chain and financials in a single "source of truth." This eliminated the lag time in reporting meter readings and well status, allowing for faster decision-making.

As uncertain market conditions linger, new technologies will continue to impact the industry. If you’re ready to move to a modern ERP that will better prepare your company for the challenges ahead, make sure you choose one that is future-ready.

Astra Canyon Group specializes in helping Oil & Gas companies navigate this digital transformation.

Contact us today to schedule a demo and see how IFS Cloud can secure your operations for 2026 and beyond.

The oil and gas industry is inherently complex, encompassing activities such as exploration, drilling, midstream logistics, refining, and...

Are your capital projects bleeding time and money because your systems don't talk?

1 min read

Is IFS Cloud ERP the Game-Changer Your Business Needs? When was the last time your ERP system felt like a growth enabler rather than just a...